How to Teach Kids & Teens with ADHD About Money Management

What’s inside this article: A guide to financial learning for kids and teens with ADHD, includes important financial literacy concepts to teach, teaching strategies and educational tools, and tips for successful financial education.

If you’re the parent of a child or teen with ADHD, you understand that managing their responsibilities can be challenging. One critical life skill that often gets overlooked or isn’t addressed early enough is financial responsibility.

In fact, a study at the University of Cambridge found that children’s money habits are formed by the time they’re 7 years old.

Impulse spending is a common behavior in adults with ADHD, so teaching kids and teens with ADHD to be responsible with money sets them up for success in the future.

In this article, we’ll explore effective strategies to help your child develop healthy financial habits while considering their unique needs.

Understanding ADHD and Financial Responsibility

Children and teens with ADHD often struggle with impulse control, organization, and following routines. These challenges can significantly impact their ability to manage money responsibly.

Additionally, children with ADHD usually have executive dysfunction. This means, compared to their peers, they’re typically about 30% behind when it comes to skills like critical thinking, problem-solving, goal setting & execution, time management, organization, etc.

So, because of that delay, it’s essential to start teaching kids about money and financial responsibility early.

Setting the Foundation for Financial Learning

Parents often don’t think about teaching financial responsibility to their kids because so much of their focus goes into more pressing and immediate issues.

For example, you may be working extra hard to teach your child how to communicate their wants and needs or how to help your child focus on their school work, that you simply don’t have the time for financial learning, too.

With so much effort going into these day-to-day tasks, teaching your kids about money may end up on the back burner. So, it’s important to stop and think about the little things you can do each day to teach financial responsibility.

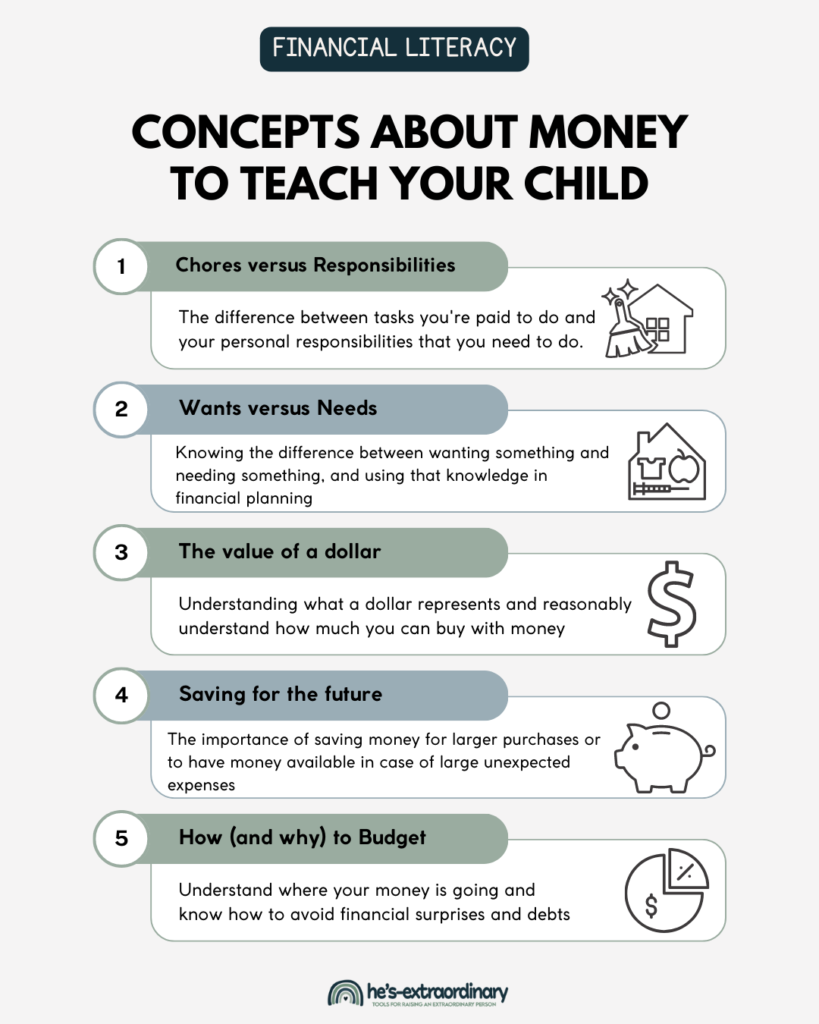

Some concepts about money to teach your child

There are many components to financial independence.

Here are some things you’ll need to consider when teaching your child:

- Work (chores) vs responsibilities

- The difference between wanting something and needing something

- The value of a dollar

- Saving for the future

- How (and why) to budget

Tools for teaching kids about money

Many different teaching tools help kids learn and master new skills. Some useful tools for financial learning include:

- Routines: Routines provide structure and predictability, which are particularly beneficial for individuals with ADHD. Establish daily or weekly routines with designated times for discussing and practicing money management.

- Visual Aids: Visual aids such as charts, graphs, and planners can help your child understand abstract financial concepts.

- Gamification: Turn financial education into a game. Create challenges that reward responsible money decisions, making learning engaging and exciting.

- Mobile Apps: Especially useful for older kids and teenagers, budgeting and banking apps can help teach financial responsibility.

Financial Learning Strategies for Kids and Teens with ADHD

This is an overview of some strategies parents can use to teach their children about money, starting from an early age and continuing through to adulthood.

When choosing strategies to help your children, it’s important to start with concepts that will be easy for your child to understand and succeed with and build upon those concepts as they master new skills.

Model Appropriate Money Habits

Children are easily influenced. Parents can start teaching kids about money by modeling financial responsibility themselves and involving their children in discussions about money.

- Talk to your children about advertising. From a young age, children need to know what advertising is. Plenty of ads are out there designed to target kids, from new toys and games to cereals to in-app ads on their tablets. Help your child understand that ads are designed to get people to spend money and create an ideal but not always the true image of a product.

- Count money with your children. Teach your children how much money you (or they) have by counting out loud and teaching them how to count money.

- Involve them in your spending. Children shouldn’t be involved in big financial decisions; you don’t need to talk to them about your mortgage payment. However, you can include them when discussing smaller purchases, such as how you decide if buying something you want fits your budget right now.

Chores & Responsibilities

It’s vital for kids to learn the difference between their responsibilities and work. You can teach them this by expecting them to have and do both.

Responsibilities are tasks they have to do. Chores are tasks they can do to earn money.

As adults, we’re responsible for keeping our houses clean, taking care of our personal hygiene, taking care of our kids, paying bills, etc. We don’t get paid to do these things; we do them because we have to.

As adults, we also go to work to earn money. We get paid for work tasks, and working is also a responsibility. But, it’s good to help children learn early on that there aren’t necessarily external rewards for their day-to-day responsibilities.

Examples of Responsibilities for Children

- Brush your teeth

- Go to school

- Do your homework

- Clean your bedroom

- Bath/Shower

- Eat dinner

- Tidy up after yourself

- Feed the family pet

Examples of Chores for Children

- Load the dishwasher

- Wipe down the tables

- Set the table

- Clean the windows

- Fold laundry

- Sweep the floor

- Take out the garbage

Remember, it’s crucial to choose developmentally appropriate chores. Ideally, you should select household chores for your child that they can do well independently or with very little assistance from you.

Pay Your Children for the Work They Do

Instead of a set allowance your child receives weekly, try creating a system where they’re paid based on the work they complete.

So, if they do nothing, they get nothing. And the more they do, the more they can earn.

This needs to be an organized and consistent system.

- Create a responsibility chart and a chore chart

- Set a specific rate of pay for various chores

- Keep a chore log to track what they’ve done

- Pay their earnings to them on the same day bi-weekly (like a real job does)

This will help your child learn that when they get paid, they need to spend wisely and make their money last until their next payday.

It’ll also teach them that if they need more money for something, like that new video game they want, they’ll need to put in some extra work.

A rule of thumb is that children should earn between $1.00 and $ 2.00 per year of age each week. So, if your child is 8, they should be able to earn between $8.00 and $16.00 per week if they complete their chores.

Saving Money

Require your child to save a set dollar amount or percentage of their allowance, even if they aren’t specifically saving up for something they want to buy.

Doing this now will help your child establish the habit of saving money in the future, and it helps kids in several ways, including:

- Builds financial discipline and confidence

- Encourages delayed gratification

- Helps kids understand the value of money

- Financial emergency preparedness – having a financial safety net when unexpected expenses arise

- Encourages goal setting

- Teaches about opportunity costs – choosing one thing over the other

- Steers kids onto a path of avoiding future debt

- Prevents impulse buying

Dave Ramsey recommends using a clear jar as a piggy bank for children who are saving money. This gives children a visual of what they’ve saved.

Watching the jar fill up with more and more money is motivating.

However, you could also place their savings into a high-interest savings account with a bank. This may be particularly helpful for older kids and teens so they can practice spending, saving, and banking like adults.

Help them understand monthly bank statements while also earning interest on their savings. If the visual is helpful, you can create a chart or graph depicting the growth of their savings over time.

Help Them Create and Follow a Budget

As your child grasps more financial responsibility concepts, you can help them make their own monthly budget. They can use their budget to estimate their monthly earnings (based on the work they’ve been doing and logging), plan what they can afford to buy, how much they should save for big purchases, etc.

They can even be responsible for their own monthly bills or expenses – for example, my son has Roblox Premium, and it’s his responsibility to ensure he has the funds available to cover the monthly subscription cost every month.

It’s a good idea to start doing a monthly budget with your child as soon as they are mature enough to understand the concepts behind the budget.

Budgeting and financial wellness are crucial skills that many adults struggle with.

Tracking & Paying Your Child’s Earnings

You need to put a system in place that will make it easy to track which chores your child completed and how much they’ve earned. This system should be simple enough that your child can look it over and understand it well.

You’ll also need to decide if you’ll get them a debit card to use or pay their allowance in cash.

I recommend using cash for younger children because it helps make the concept of money more “real”, but using a debit card helps older kids and teens build financial skills they’ll need in adulthood.

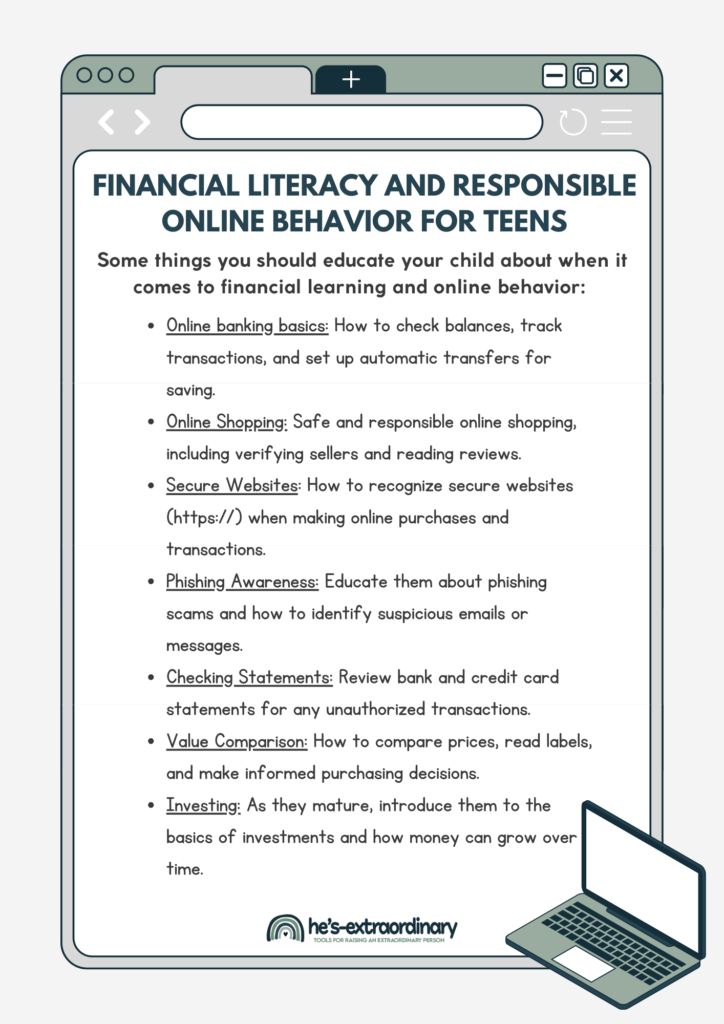

Teaching Responsible Online Behavior

In the digital age, responsible money management includes online behavior.

Some things you should educate your child about when it comes to financial learning and online behavior:

- Online banking basics: Show them how to check balances, track transactions, and set up automatic transfers for saving.

- Online Shopping: Guide them through the process of safe and responsible online shopping, including verifying sellers and reading reviews.

- Secure Websites: Show them how to recognize secure websites (https://) when making online purchases and transactions.

- Phishing Awareness: Educate them about phishing scams and how to identify suspicious emails or messages.

- Checking Statements: Teach them to regularly review bank and credit card statements for any unauthorized transactions.

- Value Comparison: Show them how to compare prices, read labels, and make informed purchasing decisions.

- Investing: As they mature, introduce them to the basics of investments and how money can grow over time.

Tips for Financial Learning Success:

- Monitor Progress and Celebrate Achievements: Keep track of your child’s financial milestones, whether saving a specific amount or successfully budgeting for a month, and regularly acknowledge their efforts and progress.

- Allow Mistakes: Let your child make small financial mistakes. These experiences provide valuable learning opportunities and encourage responsible decision-making.

- Keep it Simple: Break down complex financial concepts into simple terms that are easy for your child to grasp. Avoid overwhelming them with too much information at once. Build up to more complex concepts over time.

- Encourage Questions: Create an open environment where your child feels comfortable asking questions about money. Address their queries patiently and provide clear explanations.

- Use Practical Experiences: Take advantage of everyday experiences to teach financial lessons, such as comparing prices while shopping or discussing utility bills.

Teaching kids and teens with ADHD to be financially responsible requires patience, creativity, and a tailored teaching approach.

By integrating financial education into their daily lives and considering their unique needs, you can empower them to develop crucial money management skills with lifelong benefits.